What is behind the long list of tech layoffs?

In mid-2020 it seemed like tech couldn’t hire fast enough, but by February 2023, companies like Meta, Amazon, and Microsoft, among a host of others, had announced job cuts and layoffs adding up to some 103,000 positions in the US alone. How did the sector go from soaring growth at the beginning of the pandemic to furiously cutting jobs only a couple of years later?

In mid-2020 it seemed like tech couldn’t hire fast enough, but by February 2023, major tech companies like Meta, Amazon, and Microsoft, among a host of others, had announced job cuts and layoffs adding up to some 103,000 positions in the US alone. Amazon shuttered its Alexa division and Meta’s launch of the metaverse was underwhelming. Job cuts threaten to create a cycle where households pull back on spending, particularly on tech, and further cuts are made. But how did the sector go from soaring growth at the beginning of the pandemic to furiously cutting jobs only a couple of years later?

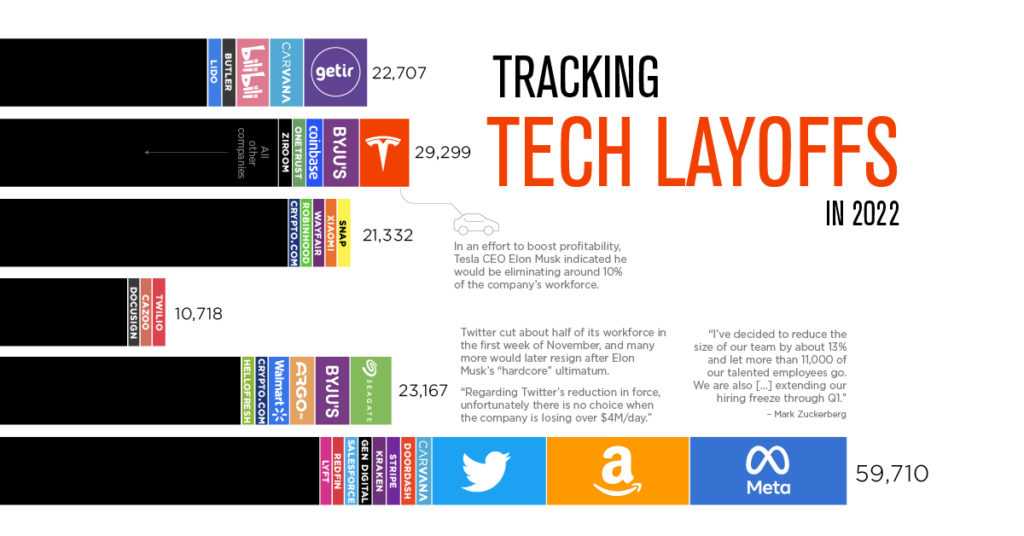

Who is laying off how many people?

If it seems as though every company in the tech sector has announced layoffs, that is not inaccurate. The list is long, ranging from startups to established international companies, with some of the more notable including:

- GitHub, the online code repository, which will be cutting around 10% of its staff

- Yahoo, which will be cutting around 1,600 employees in ad-tech

- Zoom, which will be cutting 1,300 employees or nearly 15% of its staff

- Dell, which has announced cuts to about 5% of its staff accounting for nearly 6,650 people

- Pinterest, which will be going through a second round of job cuts for a further 150 jobs

- Groupon, which will drop 500 employees across early 2023

- PayPal, which has announced 2,000 job cuts, that is about 7% of its workforce

- Spotify, which will drop around 600 employees

- Alphabet, Google’s parent company, which will cut staff from Area 120, the robotics division, and Intrinsic, amounting to some 12,000 employees being let go

- Microsoft, who are set to cut 10,000 jobs across the company

- Coinbase, that will cut nearly 20% of its workforce, about 950 jobs

- Amazon, who will make nearly 18,000 people redundant

Voice assistants were the first casualties

The tech sector has gone through booms and busts before. Not long ago, it seemed that voice assistants would be the next big thing, and teams expanded accordingly. Then Amazon’s Alexa department was announced as being axed due to an inability to monetize the service, a problem that Google Assistant also faced. And just like Amazon, Google responded by cutting resources to the product. Meanwhile Apple’s smart speaker was killed in 2021, likely due to disappointing sales from the high price tag.

Looking to more ubiquitous products like smartphones, it seems the long-running boom is beginning to slow as well. Analysis firm IDC reported that worldwide shipments of smartphones declined 8.7 percent year over year. Even Apple, whose successes with the iPhone looked set to continue indefinitely has felt this slowdown – the iPhone 14 suffered a disappointing launch and lower than expected sales that, if rumors are to be believed, has led Apple to cut iPhone production by as much as 40%.

The iPhone 14 was not a big upgrade, nor was Google’s Pixel 7, or Samsung’s Galaxy S22. Flipping and folding phones have made some headway, and could yet become the future of the smartphone, but the increasingly-smaller changes have led to analysts pointing at smartphones as evidence that the tech industry is failing to innovate and is about to crash.

A slowdown, or a maturation?

A major point to remember is that growth in the last few years was heavily spurred by the pandemic, and all that that entailed: lockdowns, work-from-home orders, restricted social gatherings, and a general increase in time spent inside. To some degree, this additional online activity may have masked the declining phone sales and problems with voice assistants, but now that people are returning to their offline lives, rather than continuing with the habits they developed during the pandemic, the facts are hard to ignore.

Couple this with higher interest rates, inflation, and recession fears, and consumer spending has naturally dropped, which of course impacts tech companies’ profits and share prices.

The huge layoff numbers now being seen and the dropping of unprofitable products are simply a reflection of this. The tech has matured and successive upgrades are no longer revolutionary nor do they guarantee huge sales figures. Alongside this, spending habits are being reined in by many. Companies are now trying to navigate these pressures, while also seeing that while the pandemic changed peoples lives drastically and increased their engagement in tech, and thus the sector’s growth trajectory, this was limited in how long its effects would last. Now people are returning to schools and offices and that engagement is falling. With it, the companies’ profits fall, so they do what all companies do in those situations: cut costs on staffing.

Sources: forbes.com / visualcapitalist.com

There are no comments

Add yours